Inland Revenue Department(IRD) is the government body that is responsible for the enforcement of Tax Laws and administration of the Income Tax, Value Added Tax, Excise Duty, Health Tax, and others in Nepal. The department has a system developed for paying revenue online through which the taxpayer can pay up to Rs 5 million (50 lakhs) per month via the electronic system.

With the help of the system, taxpayers can pay up to Rs 1 million (10 lakhs) at a time and a maximum of Rs 5 million per month. Taxpayers can pay the tax by logging into the taxpayer portal of the department’s integrated tax system. To pay taxes through this process, the taxpayer has to first verify the details from the tax office and get a username and password to login to the system.

For this, online registration can be done through Connect IPS offered by Nepal Clearing House Limited, which has been designated as a payment service provider by the Government of Nepal. Revenue can be filed by getting the username and password from there and linking the bank accounts to each other.

How to pay tax online?

-

First of all, open the Inland Revenue Department’s website on your browser. Navigate to the taxpayer portal and go to the General section within the Integrated Tax System and double click on it. You’ll see the taxpayer login menu. Click on it and log in to the system using credentials that you’ve. After that click on Proceed to the Payment option.

-

Create a voucher code number by filling the voucher details. For that, you have to select the type of revenue you want to file (one from income tax, value-added tax, or excise duties). Furthermore, the revenue title related to it, year of income, the subject for which the revenue is being filed should also be selected and the number you want to file should be entered.

-

If you have chosen income tax, you’ll have to select whether it is TDS or not. If value-added tax, add the amount of revenue to be filed and choose whether it is EC (Extra Collection) or not. If the amount is EC then proceed by choosing yes or no.

-

After that, you have to prepare the voucher details to be filed in a revenue title by clicking on the given add button. Similarly, if you want to file revenue in different titles at the same time, voucher details of other titles can be prepared in the same way.

-

In the case of the PAN office, you can choose the bank that is suitable for filing revenue from the ‘A’ list of revenue collectors like Large Taxpayer Office, Medium Level Taxpayer Office, Inland Revenue Office, Taxpayer Service Office, etc.

-

After that, click on the newly created ‘Transaction Code’ button, a request slip with a voucher code number will be generated. Click the ‘Confirm’ button to verify the details of the revenue title, amount, and fiscal year in the request slip.

-

If you want to pay the revenue directly through electronic means, you’ve to select the payment processor by clicking on the ‘Make Payment’ button and log in to Connect IPS.

-

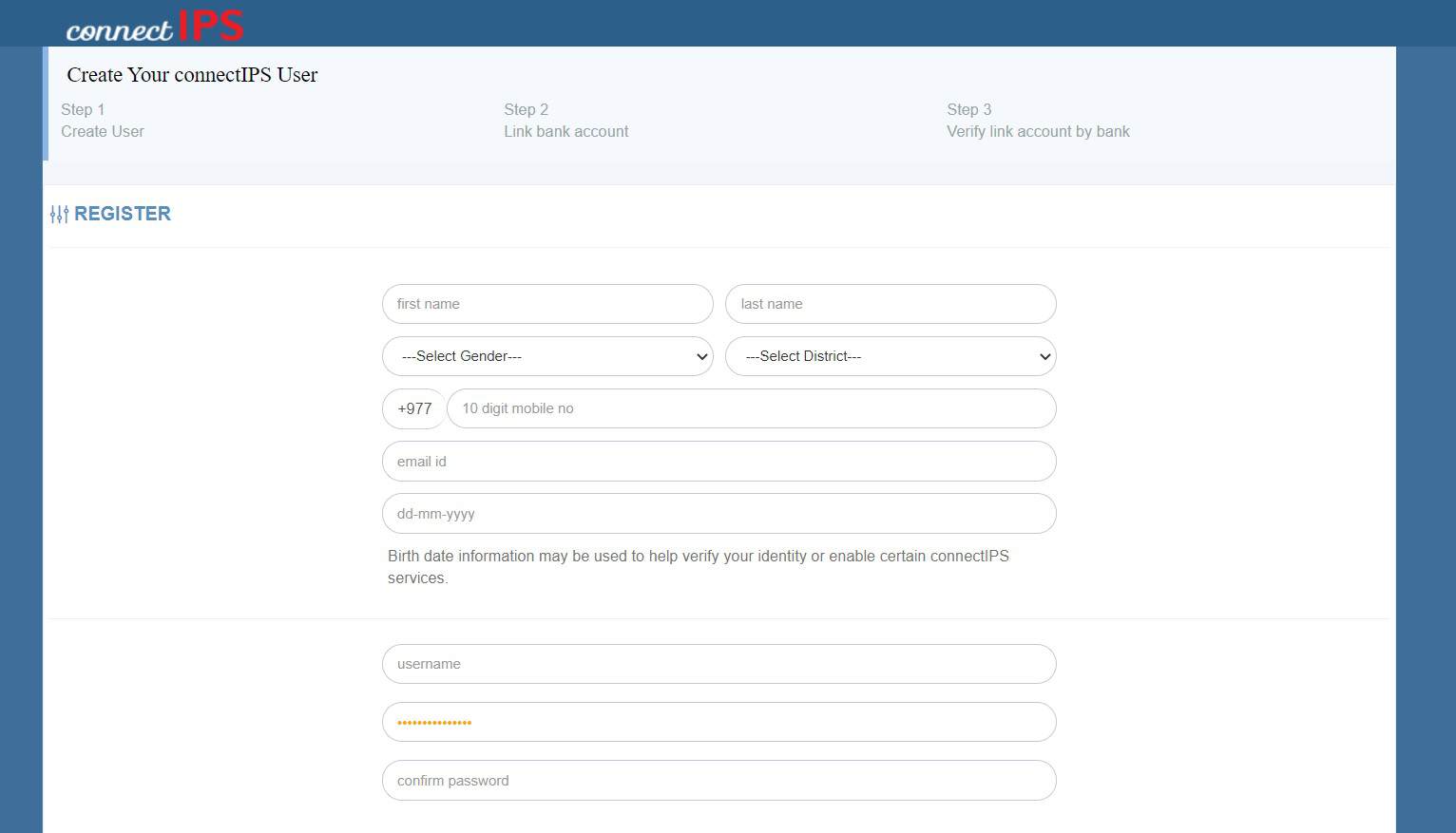

If you do not have a Connect IPS account, you can create an account from connectips.com. After creating an IPS account, you’ve to fill in the bank account details. To verify the bank linking, download the form with the details linking it to a bank account.

-

To verify your Connect IPS account linking, go to any branch of the bank and verify the bank account link. After verifying, select the bank account for filing revenue and click on the ‘Submit’ button. The Nepal Clearing House sends a one-time password to the mobile number and email account registered by the person concerned for payment verification.

-

After typing the password number and clicking on the ‘Confirm’ button, if the amount is debited from your account, the debit success page appears with success status on the request slip. In this way, the taxpayer can file a tax of Rs 1 million at a time and up to Rs 5 million per month.

Finance Minister Hints on Legalizing Cryptocurrency in Nepal

Finance Minister Hints on Legalizing Cryptocurrency in Nepal